boise idaho sales tax rate 2019

Non-property taxes are permitted at the local. Boise has seen the job market increase by 36 over the last year.

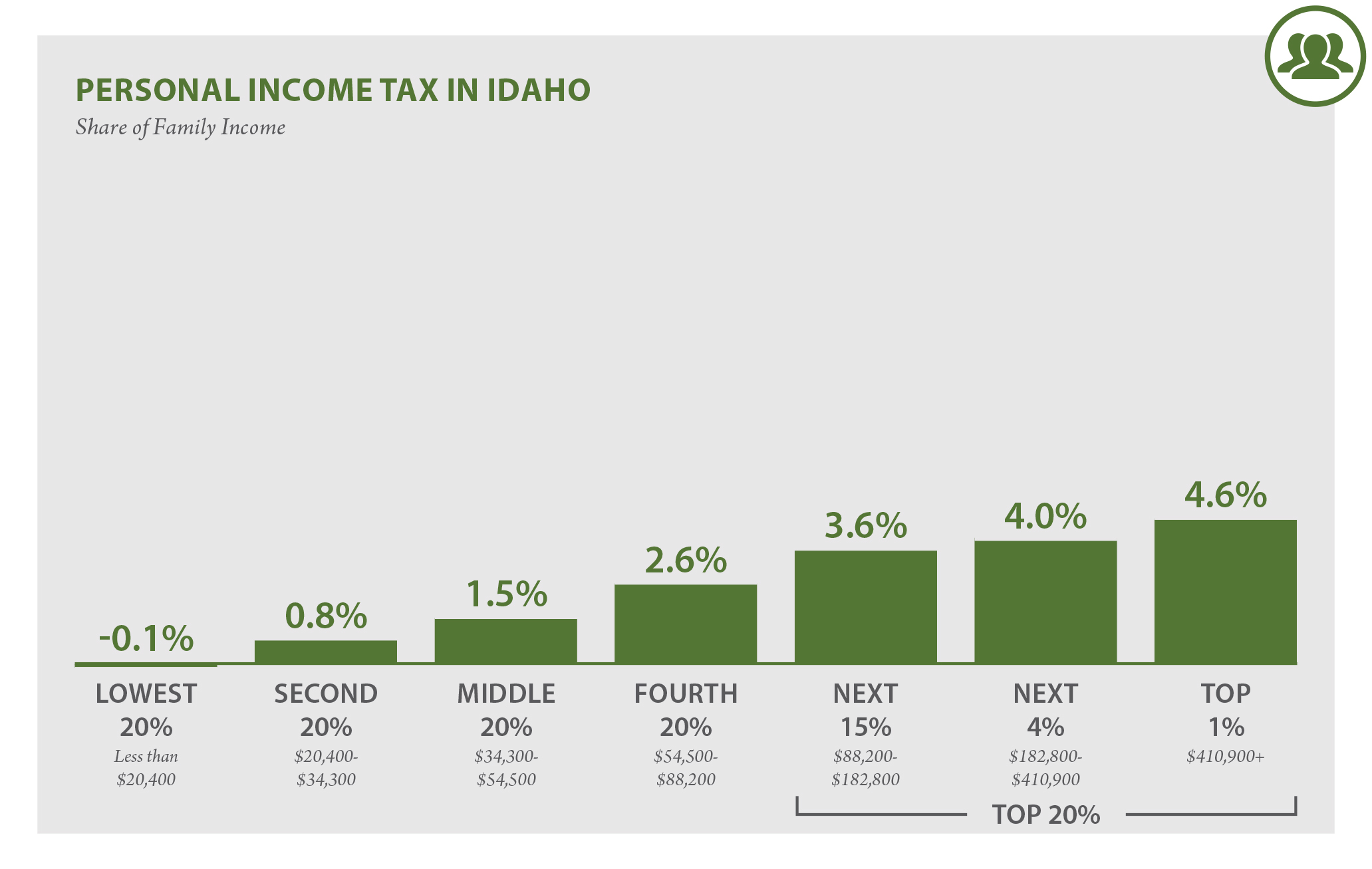

Idaho Who Pays 6th Edition Itep

Your free and reliable 2019 Idaho payroll and historical tax resource.

. The minimum combined 2022 sales tax rate for Boise Idaho is. Last full review of page January 27 2016. The current state sales tax rate in Idaho ID is 6.

This means that Idaho taxes higher earnings at a higher. What is the sales tax rate in Boise Idaho. Tax rates last updated in September 2022.

2020 rates included for use while preparing your income tax deduction. Counties and cities can charge an. Idaho 2019 Tax Rates.

The latest sales tax rate for Boise ID. This rate includes any state county city and local sales taxes. A retailer is any individual business nonprofit organization.

The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. The use tax rate is the same as the sales tax rate. Boise has an unemployment rate of 36.

This is the total of state and county sales tax rates. The total tax rate might be as high as 9 depending on local municipalities. Income tax rates range from 1 to 65 on Idaho taxable income.

Some but not all choose to limit the local sales tax to lodging. Levy Rates Voter Approved Fund Tracker 2021. There are two additional tax districts.

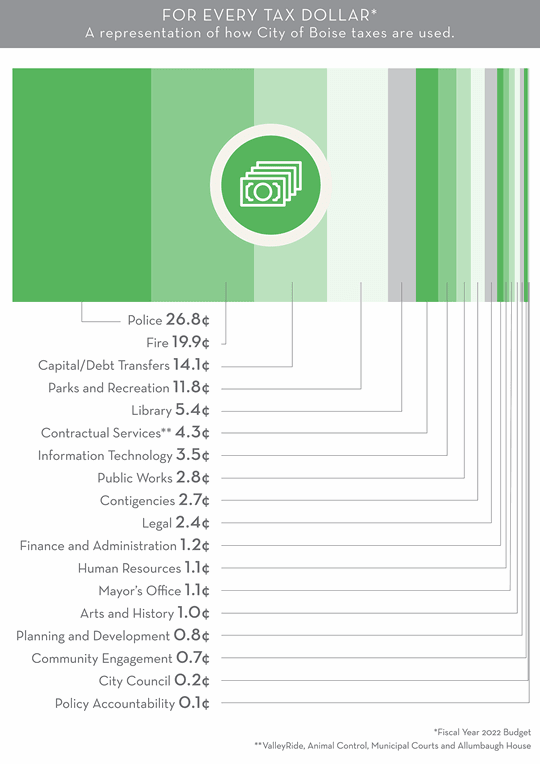

We used 2019-2021 to take out the impact of the Governors Public Safety Grant Initiative. What is the sales tax rate in Boise County. Levy rates for 2019 in Boise were at their lowest levels in at.

Boise is located within Ada County. The current Idaho sales tax rate is 6. Puerto Rico state sales tax.

Voter Approved fund tracker 2020 INFORMATION AND DATES TO REMEMBER The next tax deed sale will be September. Future job growth over the next ten years is. Payroll Resources Small Business Insights Try Payroll Trial.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. While many other states allow counties and other localities to collect a local option sales tax Idaho does not. Get Boise Property Tax Rate.

The minimum combined 2022 sales tax rate for Boise County Idaho is. The US average is 60. Prescription Drugs are exempt from the Idaho sales tax.

Sales tax region name. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Find houses and flats for sale and to rent estate agents real estate.

This is the total of state county and city sales tax rates. A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value. Individual income tax is graduated.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Idaho Tax Collections Dip Below Expectations For August

Idaho Property Tax Shift Impacts Residential Commercial Properties

Boise Idaho Id Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Hvs Hvs Market Pulse Boise Idaho

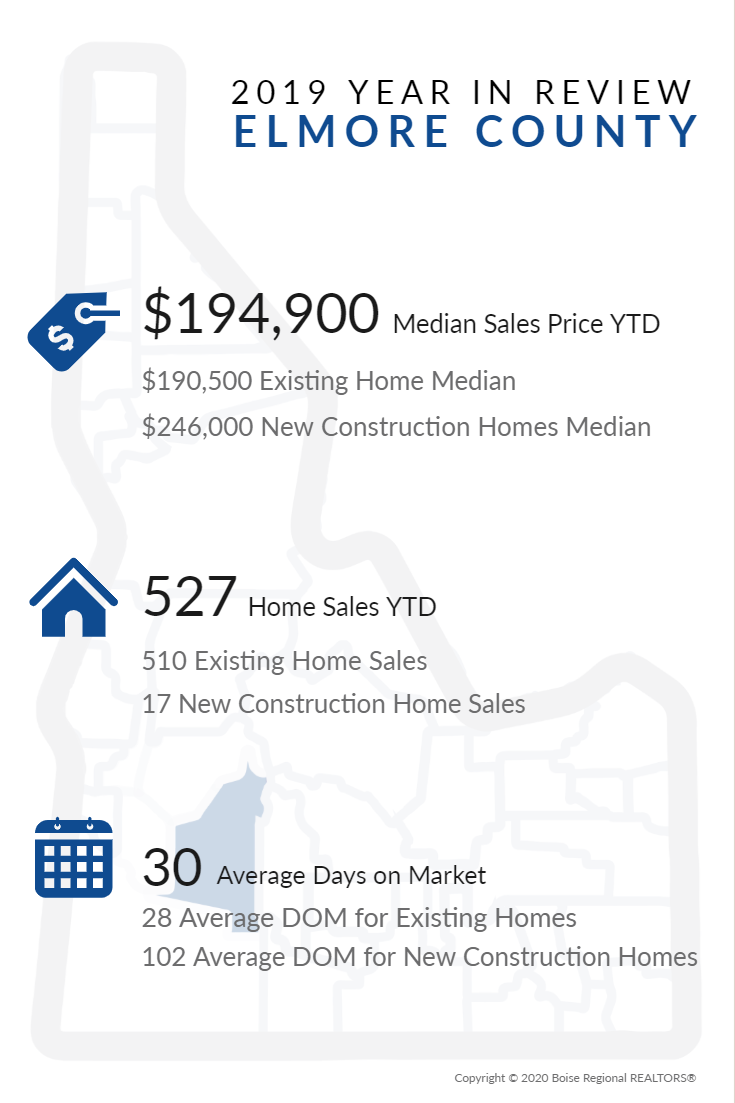

December 2019 Market Report Boise Regional Realtors

Big Income Tax Cut Bill Introduced In Idaho House Local News Idahopress Com

Used Volkswagen Atlas For Sale In Boise Id Edmunds

I Spent 4 Days In The Fastest Growing City In The Us Boise Idaho

Idaho Sales Use Tax Guide Avalara

Idaho House Approves Massive Income Tax Cut And Rebate Plan Ktvb Com

Idaho Residents Start Seeing Tax Relief Money

Idaho Special Session Will Focus On Tax Cuts Education Funding Boise State Public Radio

Idaho S Circuit Breaker Changes Will Disproportionately Affect Low Income Seniors Idaho Capital Sun

Idaho Sales Tax Rate Rates Calculator Avalara

Overview Of The Tax Season Tax Reporting

State And Local Sales Tax Rates 2019 Tax Foundation

Overview Of The Tax Season Tax Reporting

Ontario Oregon Continues Selling Over 9 Million Worth Of Cannabis Monthly Mostly To Idahoans R Boise